alpinistory.ru

News

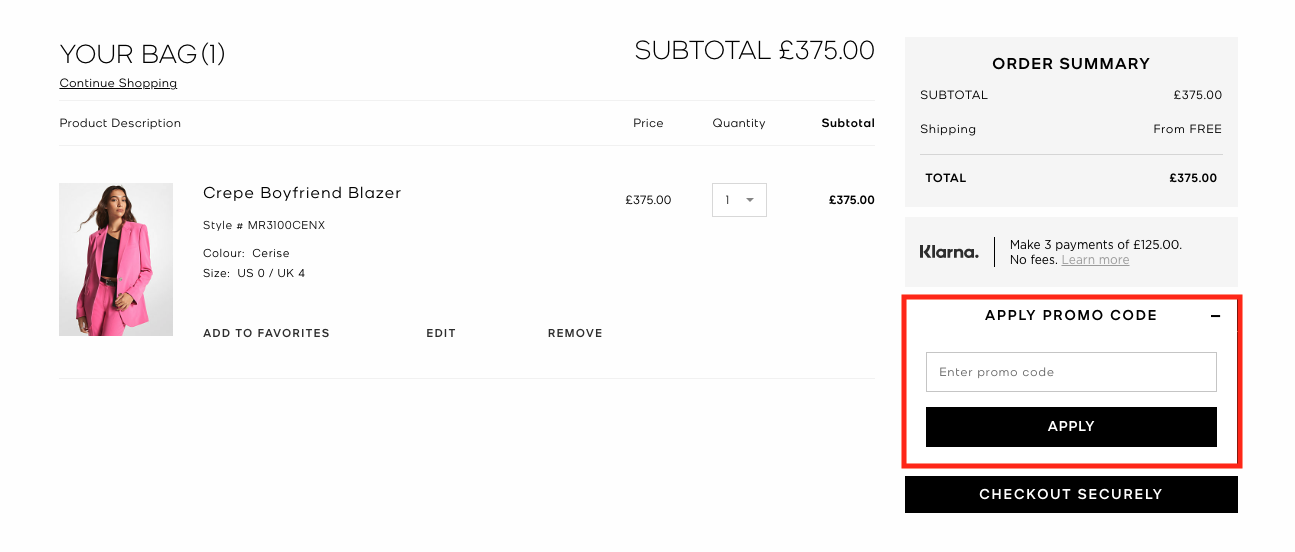

Michael Kors Coupon First Order

Top Michael Kors Coupons and Promo Codes. Description: Expires On: Discount: Sign Up For KORSVIP and Receive 10% Off Your First Order! 33+ active Michael Kors Promo Codes, Coupons & Deals for August Most popular: 15% Off Michael Kors Promo Code: BONUS***** from DontPayFull. 10% Off Your 1st Order with KORSVIP Sign Up. 41 uses today. Get Deal. See Details. Sale. SALE +5% CASH BACK. Shop New Travel Nylon Bags & Accessories. 4 uses. Michael Kors Coupons and Promo Codes · 20% Off. CODE. 20% Off already-reduced styles · 10% Off. CODE. Grab 10% Off Site-wide · $50 Off. CODE. $50 Off Religible. Most Used Michael Kors Discount Codes & Sales. Deal, Savings, Status. Use this Michael Kors Canada promo code for 10% off your first order, Save with the latest Michael Kors discount codes and promotions ⭐ Today's Michael Kors promo code: 10% OFF from CupoNation Singapore. Sign Up For KORSVIP and Receive 10% Off Your First Order! Deal. Promo One way is to shop savvy is by grabbing one of our Michael Kors coupons. Or. Save up to 25% in discounts when you shop at the "Sale" section of the Michael Kors website. Alternatively, you can also discover more Michael Kors coupons and. Save 20% with 16 verified Michael Kors promo codes for August SimplyCodes uses AI and crowdsourcing to find Michael Kors coupons that actually work! Top Michael Kors Coupons and Promo Codes. Description: Expires On: Discount: Sign Up For KORSVIP and Receive 10% Off Your First Order! 33+ active Michael Kors Promo Codes, Coupons & Deals for August Most popular: 15% Off Michael Kors Promo Code: BONUS***** from DontPayFull. 10% Off Your 1st Order with KORSVIP Sign Up. 41 uses today. Get Deal. See Details. Sale. SALE +5% CASH BACK. Shop New Travel Nylon Bags & Accessories. 4 uses. Michael Kors Coupons and Promo Codes · 20% Off. CODE. 20% Off already-reduced styles · 10% Off. CODE. Grab 10% Off Site-wide · $50 Off. CODE. $50 Off Religible. Most Used Michael Kors Discount Codes & Sales. Deal, Savings, Status. Use this Michael Kors Canada promo code for 10% off your first order, Save with the latest Michael Kors discount codes and promotions ⭐ Today's Michael Kors promo code: 10% OFF from CupoNation Singapore. Sign Up For KORSVIP and Receive 10% Off Your First Order! Deal. Promo One way is to shop savvy is by grabbing one of our Michael Kors coupons. Or. Save up to 25% in discounts when you shop at the "Sale" section of the Michael Kors website. Alternatively, you can also discover more Michael Kors coupons and. Save 20% with 16 verified Michael Kors promo codes for August SimplyCodes uses AI and crowdsourcing to find Michael Kors coupons that actually work!

The top Michael Kors promo code today is EXTRAEXTRA. This code is for 'Up to 70% Off! Plus, Save an Additional 20% w/ Code EXTRAEXTRA'. How to use Michael Kors coupon codes? · Click on one of the top Michael Kors coupon codes. · Add your favorite items to your shopping cart, view cart when you. What is the best Michael Kors discount code available? The best Michael Kors discount code available is 'VIPSTUDIO2JS3MGAW'. This code gives customers 70% off. The Best Michael Kors Coupon Code is MKFIRST. This code gives an instant 10% Off at Michael Kors. It has been used 39 times. If you like Michael Kors you might. You can get a Michael Kors promo code for 10% off your first purchase by subscribing to the newsletter. Enter your email into the pop-up on the homepage, and. Michael Kors promo codes, coupons & deals, August Save BIG w/ (2) Michael Kors verified discount codes & storewide coupon codes. Elevate Your Style with Luxury Fashion at Discounted Rates Through Latest Michael Kors Promos, Coupons & Discount Codes. Avail Cash Incentives Right Away! Michael Kors coupons, codes, and deals. Finding deals is our thing. This promo code was gathered from the internet. This deal is subject to availability. Michael Kors Coupon Code, Offers, Discount Codes and Deals August Up to 50% Off Promo Code on luxury designer, handbags, watches, shoes, clothing and. Save with Active Michael Kors promo codes and coupons. Find the best Michael Kors discount codes and deals from BrokeScholar. Michael Kors First Order Discount: Unlock a Michael Kors 10% off discount on your first purchase by subscribing to their email list. This also grants you access. Get Coupon. Expires Aug. 31, Save. Coupon Code. 30% off. Save up to 30% if any of these Michael Kors promo codes apply to your order. EXTRASALE. $ avg. Sign up & get flat 10% off on luxury clothing, footwear, accessories and many more. Offer applicable on non discounted products on your first order at Michael. Shop with 25 working Michael Kors discount codes and grab all the latest deals on bags and watches this August Receive 10% OFF when you sign up for. 2 Michael kors Coupons Available For Today · Up to 60% Off On Luxury Shoes & Bags – Michael Kors Promo Code UAE · Shop Michael Kors Accessories At 40% Discount. alpinistory.ru Coupon & Promo Codes Enjoy A 20% Discount On Select Sale Styles. Make Your Purchases Today! 49 Used ·. 13 curated promo codes & coupons from Michael Kors tested & verified by our team on Aug Get deals from 20% to 85% off. Shop collections, sales and special promotions online, and apply a Valpak Michael Kors coupon code for extra smart savings. You can get exclusive savings with Michael Kors promo codes, such as 10% off Michael Kors promo code first order and other offers. Get the latest August coupons and promotion codes automatically applied at checkout. Plus get up to 3% back on purchases at Michael Kors and thousands.

Should I Invest In Altcoins

Research your altcoins – You should consider investing in altcoins if you're going to make crypto part of your portfolio and you have time to spend researching. Many people have lost money trading cryptocurrency due to having their seed phrases compromised, investing in risky, illegitimate projects and. Should you consider investing in Altcoins? Investing in altcoins can be an exciting opportunity for individuals looking to diversify their investment portfolios. In fact, most cryptocurrency investors minimize risk by diversifying their portfolios into multiple assets. Should I Invest in Altcoins? Grayscale Investments. The best altcoins to invest in are Ether (ETH), XRP (XRP) and BNB Coin (BNB). This information prepared by capex. We analyze the best altcoins to invest in right now, looking at their price potential, use cases, and previous performance. Other altcoins have performed extremely well as long-term investments, but investors should understand the unique risks of investing in altcoins before. In this article, we recommend purchasing BTC and trading BTC for the desired altcoin. Many, if not most altcoins, should be paired with BTC on one of the. To this day, ethereum is by far the most valuable altcoin, making up nearly 19% of the market cap of the entire global cryptocurrency market. Ethereum's. Research your altcoins – You should consider investing in altcoins if you're going to make crypto part of your portfolio and you have time to spend researching. Many people have lost money trading cryptocurrency due to having their seed phrases compromised, investing in risky, illegitimate projects and. Should you consider investing in Altcoins? Investing in altcoins can be an exciting opportunity for individuals looking to diversify their investment portfolios. In fact, most cryptocurrency investors minimize risk by diversifying their portfolios into multiple assets. Should I Invest in Altcoins? Grayscale Investments. The best altcoins to invest in are Ether (ETH), XRP (XRP) and BNB Coin (BNB). This information prepared by capex. We analyze the best altcoins to invest in right now, looking at their price potential, use cases, and previous performance. Other altcoins have performed extremely well as long-term investments, but investors should understand the unique risks of investing in altcoins before. In this article, we recommend purchasing BTC and trading BTC for the desired altcoin. Many, if not most altcoins, should be paired with BTC on one of the. To this day, ethereum is by far the most valuable altcoin, making up nearly 19% of the market cap of the entire global cryptocurrency market. Ethereum's.

However, the success in altcoin investing hinges on thorough research and informed decision-making. Understanding each altcoin's technology, market behaviour. Don't invest unless you're prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes. Should I invest in altcoins? Altcoins are alternative digital currencies that offer more uses than Bitcoin, which is mainly used for storing value. Altcoin. Choose a reputable platform: To trade altcoins, users need an account with a cryptocurrency platform. They should invest, buy, or sell any coins. How will investing in cryptocurrency affect your portfolio? Is it a good long-term investment? Should you invest in an initial coin offering (ICO)? Are non. In this guide, we'll list and review what our analysts consider the top altcoins to watch now and where to buy altcoins safely on a secure crypto platform. Investing in altcoins attracts many technology enthusiasts and investors looking to diversify their cryptocurrency portfolios. Beyond bitcoin and ether. While there are certainly risks involved in investing in altcoins, there is also potential for significant gains. For example, in the altcoin Ripple saw a. It may give you some insight into the types of projects you should invest in across the wider crypto universe. We make investing in altcoins easy, allowing. You should consider investing in altcoins if you're going to make crypto part of your portfolio and you have time to spend researching them. Some altcoins are. You should avoid storing a substantial amount of crypto in your exchange wallet. If the exchange is fraudulent or is targeted by hackers, you'll lose those. Investing in altcoins is an inexpensive way of diversifying the investment portfolio beyond BTC. Moreover, investors can participate in the governance decisions. As I mentioned earlier, altcoins can be quite risky. But that doesn't mean they're a terrible investment. The important thing is to stay updated. Cryptocurrency Investing table Some investors are attracted to the volatile price swings as a potential for profit. Some investors believe that if the lack. The key to finding the best altcoins on is to conduct thorough research which can include looking at a coin's market cap, use cases, team, road map and more. Ethereum is the largest and most important altcoin, as it powers many tokens and decentralized applications and dominates the decentralized finance space (DeFi). Does that mean you should sit on your hands and wait to buy altcoins until you know who will win or lose? Until the US works out its crypto. You could invest in cryptocurrency directly, or you might take the less direct route and purchase a stock or fund invested in blockchain development. Either way. Some analysts say altcoins have yet to collapse against bitcoin and our most recent pump is an echo bubble or bear-market rally, destined to fail.

Single 401k

The Ascensus Individual(k) solution is designed for sole proprietors and other owner-only businesses looking for a solo (k) plan that's cost-effective. Owner-only (k) plan. You may be a one-person business, but you can save for retirement like a large company. The Edward Jones Owner K plan is designed to. An Individual (k) plan is available to self-employed individuals and business owners, including sole proprietors, owner-only corporations, partnerships, and. The solo (k) allows you to pay yourself twice, both as the employer and as the employee. The “employee” contribution you can make is limited to $22, The. A Self-Employed (k), also called a solo (k), is a version of the traditional (K) that provides high savings potential for solo business owners. A solo (k) is a (k) for self-employed people. You can make solo (k) contributions as both the employer and employee. In , self-employed individuals can contribute up to $ to a solo (k) (or up to $ if at least age 50) plus up to 25% of compensation as an. Individual (k) Plan with Traditional and Roth (k) contributions · For self-employed workers and their spouses to maximize retirement savings · Generous. An Individual(k)—also known as Individual (k)—maximizes retirement savings if you're self-employed or a business owner with no employees other than your. The Ascensus Individual(k) solution is designed for sole proprietors and other owner-only businesses looking for a solo (k) plan that's cost-effective. Owner-only (k) plan. You may be a one-person business, but you can save for retirement like a large company. The Edward Jones Owner K plan is designed to. An Individual (k) plan is available to self-employed individuals and business owners, including sole proprietors, owner-only corporations, partnerships, and. The solo (k) allows you to pay yourself twice, both as the employer and as the employee. The “employee” contribution you can make is limited to $22, The. A Self-Employed (k), also called a solo (k), is a version of the traditional (K) that provides high savings potential for solo business owners. A solo (k) is a (k) for self-employed people. You can make solo (k) contributions as both the employer and employee. In , self-employed individuals can contribute up to $ to a solo (k) (or up to $ if at least age 50) plus up to 25% of compensation as an. Individual (k) Plan with Traditional and Roth (k) contributions · For self-employed workers and their spouses to maximize retirement savings · Generous. An Individual(k)—also known as Individual (k)—maximizes retirement savings if you're self-employed or a business owner with no employees other than your.

The Ascensus Individual(k) plan featuring Vanguard investments is a great option for small business owners looking for an owner-only plan. A (k) qualified retirement plan for Americans that was designed specifically for employers with no full-time employees other than the business owner(s) and. You can choose between two main retirement plans: the solo (k) and the SEP IRA. Which self-employed retirement savings plan is right for you depends on your. It's a traditional (k) plan covering a business owner with no employees, or that person and his or her spouse. A (k) plan designed especially for you. With Fidelity, you have no account fees and no minimums to open an account. An Individual (k) plan is available to self-employed individuals and business owners, including sole proprietors, owner-only corporations, partnerships, and. Compare the small business retirement plans we offer: i(k), SEP-IRA, SIMPLE IRA, and Small Plan (k) Ascensus Individual(k). Plan sponsors and. An Individual (k) or Solo (k) is a flexible retirement plan designed for self-employed small business owners. Open an account with Merrill today. Solo k Eligibility: only two requirement - presence of self-employment activity and absence of full time employees (spouse is not considered an employee. A solo (k) plan is essentially a (k) plan designed for a business with no full-time employees other than the owners and/or their spouses. The Solo k provides more investment options, higher contribution limits, and the lowest fees of any fully self directed retirement plan. Maximize your retirement savings with Ubiquity's Solo (k) plans tailored for self-employed professionals and small business owners. Individual or solo (k). A solo (k) is intended for sole proprietors and other small businesses who have no employees other than a spouse. Through a. A Solo (k) plan is an employer sponsored retirement savings plan that is designed specifically for owner-only businesses. A solo k plan is the same as a traditional k (full-time employer k plan) except it is for an owner-only business that does not employ full-time, non-. A Solo (k) offers a low-cost retirement plan solution that allows solo business owners to maximize their retirement contributions in a tax-advantaged. A (k) Plan as Unique as Your Business. Single Employer Plans offer businesses maximum flexibility for businesses with more complex needs. This post will cover how to calculate solo (k) contribution limits. We'll cover the contribution calculations, the deadlines, and everything else you need. Use the Solo (k) Contribution Comparison to estimate the potential contribution that can be made to a Solo (k) plan, compared to Profit Sharing, SIMPLE. A one-participant (k) plan is sometimes referred to as a “solo(k),” “individual (k)” or “uni(k).” It is generally the same as other (k).

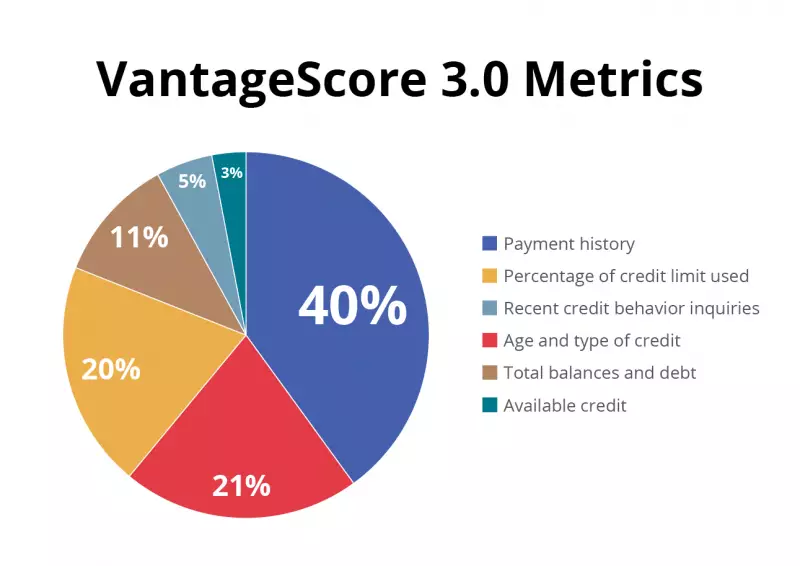

Who Uses Vantage 3.0 Credit Score

Moving from the current Classic FICO credit score model to require lenders to use two credit scores generated by the FICO Score 10 T and the VantageScore VantageScore is a credit rating service that caters directly to individual consumers. The scores generated by VantageScore fall between and . Most top 10 US banks, large credit unions and leading fin-techs use VantageScore credit scores in one or more lines of business including credit cards, auto. Extremely Low Weight: Available Credit (3%) — It's the amount of credit you have available to use. Keep in mind that the VantageScore model is used by Credit. FICO and VantageScore use the same information – your credit reports – to generate your credit score. They may process this information in different ways. The FICO score and the Vantage Score are two different scoring models. The Vantage Score was developed by all three credit reporting companies: Experian. More than 3, institutions use VantageScore credit scores to provide consumer credit products like credit cards, auto loans, personal loans and mortgages. FICO and VantageScore are the two main companies that create and maintain credit scoring algorithms. Lenders most frequently use the FICO Score. If you are applying for credit, you might consider asking which credit score the lender will use to evaluate your request. VantageScore® credit score. Moving from the current Classic FICO credit score model to require lenders to use two credit scores generated by the FICO Score 10 T and the VantageScore VantageScore is a credit rating service that caters directly to individual consumers. The scores generated by VantageScore fall between and . Most top 10 US banks, large credit unions and leading fin-techs use VantageScore credit scores in one or more lines of business including credit cards, auto. Extremely Low Weight: Available Credit (3%) — It's the amount of credit you have available to use. Keep in mind that the VantageScore model is used by Credit. FICO and VantageScore use the same information – your credit reports – to generate your credit score. They may process this information in different ways. The FICO score and the Vantage Score are two different scoring models. The Vantage Score was developed by all three credit reporting companies: Experian. More than 3, institutions use VantageScore credit scores to provide consumer credit products like credit cards, auto loans, personal loans and mortgages. FICO and VantageScore are the two main companies that create and maintain credit scoring algorithms. Lenders most frequently use the FICO Score. If you are applying for credit, you might consider asking which credit score the lender will use to evaluate your request. VantageScore® credit score.

In , the 3 major credit bureaus – Experian, TransUnion, and Equifax – joined forces to create a VantageScores® credit scoring model to compete with FICO. Lenders are able to extend credit safely and soundly to consumers historically underserved by legacy processes with VantageScore models -- which are proven. The range for VantageScore takes after the FICO model and is – The higher the number, the better the credit score. So if you want to know what is. VantageScore is here and TenantTracks uses this scoring model. This will not only impact the industry in tremendous ways, but the way your applicants. The free TransUnion and Equifax credit scores are based on the VantageScore model. Free credit scores found on Credit Karma are also based on VantageScore. U.S. Bank does not use your VantageScore to make credit decisions. Free credit score example - Transunion VantageScore® Set yourself up for credit. Medina says the most widely used version today is FICO Score 8, though FICO Score 9 is also used often. He adds that there are also industry-specific FICO. With the VantageScore credit risk model, consumers who were previously unscoreable can be analyzed. VantageScore also outscores other credit scoring. Improve delinquency predictiveness while expanding your lending universe with the first tri-bureau credit scoring model using trended credit data developed. Vantage Score uses – range. The following credit scores are unrelated to FICO or VantageScore. They are proprietary scores of these credit reporting. VantageScore is a consumer credit-scoring system in the United States, created through a joint venture of the three major credit bureaus (Equifax, Experian. VantageScore's first two credit scoring models had ranges of to The two newest VantageScore credit scores (VantageScore and ) use a to. Alternative Data – VantageScore will accept alternative scoring data, such as rent and phone payments if they have been reported to the major credit bureaus. Some lenders use another scoring model, VantageScore, especially credit card companies. 3-bureau credit monitoring, alerts and reports: Experian. Credit card companies and auto lenders also use it. But it's up to each lender to decide which credit scoring model and which version of that model it wants to. The VantageScore model generates credit scores that are: • More predictive, because the model uses more granular data. • More consistent, thanks to a unique. Discover how Dispute Beast's credit monitoring service, using Vantage , simplifies credit repair just as effectively as FICO scores. Extremely Low Weight: Available Credit (3%) — It's the amount of credit you have available to use. Keep in mind that the VantageScore model is used by Credit. Many lenders use the model in addition to other models, like the model or FICO score, to get a wider picture of the consumer. However, the consumer. VantageScore ranges from to , just like the FICO score does. Here are its credit score ranges: A good, or "prime," VantageScore ranges from to.

How To Buy Tips Etf

Vanguard Short-Term Inflation-Protected Securities ETF (VTIP) - Find objective, share price, performance, expense ratio, holding, and risk details. To begin, we need to recognize there are two ways one can hold TIPS and nominal bonds: purchase the bonds individually or invest in mutual funds/ETFs. When. We sell TIPS for a term of 5, 10, or 30 years. As the name implies, TIPS are set up to protect you against inflation. TIPS are a type of government bond issued by the US Treasury, whose face value and interest payments are adjusted for inflation, as measured by US CPI. Benefits. TIPS can provide a hedge against inflation, as the inflation adjustment feature helps preserve the purchasing power of the investment. TIPS offer unique inflation protection, consider including TIPS in your investment portfolio. You can also buy TIPS through a mutual fund or ETF. At auction. Here are the best Inflation-Protected Bond funds · SPDR® Portfolio TIPS ETF · iShares TIPS Bond ETF · Schwab US TIPS ETF™ · FlexShares iBoxx 5Yr Target Dur TIPS ETF. The majority of these funds invest in Treasury inflation-protected securities (TIPS), which are U.S. treasury securities that are indexed to the Consumer Price. The iShares Year TIPS Bond ETF seeks to track the investment results of an index composed of inflation-protected U.S. Treasury bonds with remaining. Vanguard Short-Term Inflation-Protected Securities ETF (VTIP) - Find objective, share price, performance, expense ratio, holding, and risk details. To begin, we need to recognize there are two ways one can hold TIPS and nominal bonds: purchase the bonds individually or invest in mutual funds/ETFs. When. We sell TIPS for a term of 5, 10, or 30 years. As the name implies, TIPS are set up to protect you against inflation. TIPS are a type of government bond issued by the US Treasury, whose face value and interest payments are adjusted for inflation, as measured by US CPI. Benefits. TIPS can provide a hedge against inflation, as the inflation adjustment feature helps preserve the purchasing power of the investment. TIPS offer unique inflation protection, consider including TIPS in your investment portfolio. You can also buy TIPS through a mutual fund or ETF. At auction. Here are the best Inflation-Protected Bond funds · SPDR® Portfolio TIPS ETF · iShares TIPS Bond ETF · Schwab US TIPS ETF™ · FlexShares iBoxx 5Yr Target Dur TIPS ETF. The majority of these funds invest in Treasury inflation-protected securities (TIPS), which are U.S. treasury securities that are indexed to the Consumer Price. The iShares Year TIPS Bond ETF seeks to track the investment results of an index composed of inflation-protected U.S. Treasury bonds with remaining.

Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV). Treasury Inflation Protected Securities (TIPS) are. TIPS ETFs are composed of TIPS (Treasury Inflation-Protected Securities). These bonds help investors fend against inflation, since they are linked to. TIP | A complete iShares TIPS Bond ETF exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF investing. Always make sure your ETFs have reporting fund status. This enables you to avoid a nasty tax shock in the future. Offshore capital gains are liable to tax at. The best-performing funds are the iShares Year TIPS Bond ETF, Vanguard Short-Term Inflation-Protected Securities ETF, and Invesco PureBeta Yr US. %. Buy · ISHARES TIPS BOND ETF. TIP | All Star.. Category. Inflation-Protected Bond. Market Price. $ Today's % Change. %. Expense Ratio. Vanguard Short-Term Inflation-Protected Securities ETF seeks to track the performance of the Bloomberg U.S. Treasury Inflation-Protected Securities (TIPS) 0–5. TIPS Funds and ETFs are mutual funds that allow investors to tap into the domestic bond market. Treasury inflation-protected securities (TIPS) include both. Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV). Treasury Inflation Protected Securities (TIPS) are. You can purchase TIPS directly from the U.S. Treasury for a minimum purchase amount of $1, You may also choose a mutual fund or exchange-traded fund that. SPDR® Portfolio TIPS ETF · iShares TIPS Bond ETF · Schwab US TIPS ETF™ · FlexShares iBoxx 5Yr Target Dur TIPS ETF · PIMCO 15+ Year US TIPS ETF · Simplify Interest. The SPDR® Portfolio TIPS ETF seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance. The iShares iBonds Oct Term TIPS ETF seeks to track the investment results of an index composed of US Treasury Inflation-Protected Securities (TIPS). TIPS ETF List. TIPS ETFs are composed of TIPS (Treasury Inflation-Protected Securities). These bonds help investors fend against. You can purchase TIPS directly from the U.S. Treasury for a minimum purchase amount of $1, You may also choose a mutual fund or exchange-traded fund. (TIPS) have historically helped investors hedge against inflation and diversify traditional portfolios. In an inflationary environment, investing in TIPS may. Why Invest in RINF? Offers a portfolio of year Treasury Inflation-Protected Securities (TIPS) bonds. Seeks to mitigate the risk of rising rates through a. ETF Shares are not individually redeemable and owners of the Shares may acquire those Shares from the Funds and tender those Shares for redemption to the Funds. Find the latest iShares TIPS Bond ETF (TIP) stock quote, history, news and other vital information to help you with your stock trading and investing.

How To File Old 1099

If you cannot get a copy of your W-2 or , you can still file taxes by filling out Form , “Substitute for Form W-2, Wage and Tax Statement.” This form. You can view your Form G amount by visiting myconneCT, the Department's new state-of-the-art online filing and paying portal and selecting What's My G. Try our Prior year forms & publications search to quickly find and download prior year forms, instructions and publications. To get started, enter keywords. Taxpayers may request copies of any tax return or other previously filed document by completing a Tax Information Disclosure Authorization, Form R Click “R Summary” under My Payroll Information. Follow the prompts to access your R Form for the tax year that just ended. You will also be able to. Select the tax year to see a list of available forms and instructions. For forms not listed, or if you are unable to download and print forms from our website. Prepare old tax returns online. Federal filing is always free. State filing is $ File back taxes for , , , and other years. copies of all W-2 and forms;; your property number and amount of What if I need to file a prior year Form IL? For tax years through. If you are looking for s from earlier years, you can contact the IRS and order a “wage and income transcript”. The transcript should include all of the. If you cannot get a copy of your W-2 or , you can still file taxes by filling out Form , “Substitute for Form W-2, Wage and Tax Statement.” This form. You can view your Form G amount by visiting myconneCT, the Department's new state-of-the-art online filing and paying portal and selecting What's My G. Try our Prior year forms & publications search to quickly find and download prior year forms, instructions and publications. To get started, enter keywords. Taxpayers may request copies of any tax return or other previously filed document by completing a Tax Information Disclosure Authorization, Form R Click “R Summary” under My Payroll Information. Follow the prompts to access your R Form for the tax year that just ended. You will also be able to. Select the tax year to see a list of available forms and instructions. For forms not listed, or if you are unable to download and print forms from our website. Prepare old tax returns online. Federal filing is always free. State filing is $ File back taxes for , , , and other years. copies of all W-2 and forms;; your property number and amount of What if I need to file a prior year Form IL? For tax years through. If you are looking for s from earlier years, you can contact the IRS and order a “wage and income transcript”. The transcript should include all of the.

For G or S, you may call () Contact us to ask a question, provide feedback, or report a problem. The Department of Revenue's G only applies to individuals who itemize their deductions on their income tax return. If you claimed the standard deduction. When filing an electronic return, attach scanned copies of all W-2s and/or s that show Colorado income tax withholding to the e-filed tax return. If you are. Form DEZ is no longer available for use for Tax Year and later. Taxpayers who used this form in the past must now use Form D Please select the. You can get this transcript in four ways · 1. Mail Form T, Request for Transcript of Tax Return, to the IRS. · 2. Order your transcript by phone or online. Tax preparation assistance · AARP Tax-Aide. Free services provided to anyone, with a focus on taxpayers who are over 50 years old and have low to moderate income. Also, you have the ability to view payments made within the past 61 months. Account Management. Allows you to view/print transcripts of previously filed returns. Your North Carolina income tax return (Form D). Federal forms W-2 and showing the amount of North Carolina tax withheld as reported on Form D, Line. Sign in to your account, click on Documents in the menu, and then click the R tile. We'll send your tax form to the address we have on file. You can verify. Form G reflects all Kentucky refunds that were credited to you for last year, including refunds from amended returns and prior year returns. The form. Duplicate copies of , G, or S must be obtained from the Office of Financial Management (OFM). For s, contact OFM's Customer Service number. No problem: You can e-file without the physical in hand. Here's what to do: Just like W-2s, s are supposed to be sent by the end of January each year. File and save your federal tax return first, if required to file it. Gather your income information and any other necessary documents (W-2s, s. Taxpayers receiving Form G, which serves as a confirmation of the previous year's state tax refund, can go online to search, download, and print the form. If you previously had an account with Online Services\I-File (prior to September 5, ), your username is no longer valid, and you will need to create a. If you need a form prior to year , please email your request to taxforms Preguntas Frecuentes Acerca De La Forma G. About Fill-out Forms. payments or refundable credits except for Illinois withholding from W-2, W-2G, G, INT, or R, estimated payments, or Earned Income Credit. GATHER. Persons who are both age 65 or older and legally blind are eligible Form G reflects all Kentucky refunds that were credited to you for last. For G or S, you may call () Contact us to ask a question, provide feedback, or report a problem. prior year federal Form However, you will not need to amend your Connecticut income tax return because the overpayment is not taxable for Connecticut.

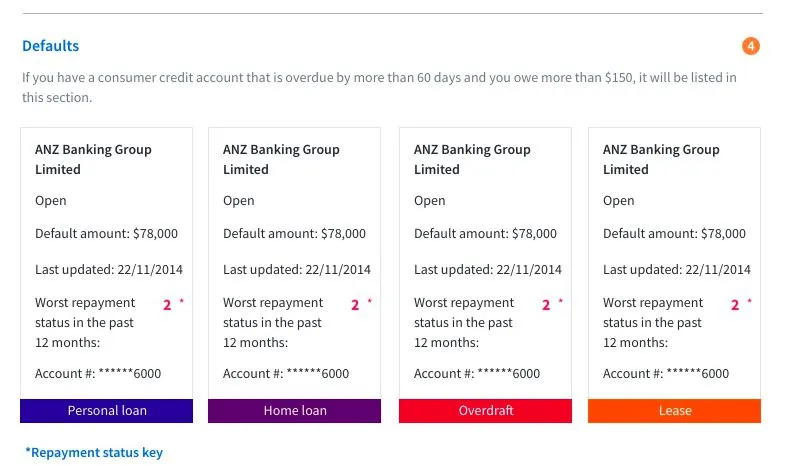

Default On Credit

A default will remain on your credit history for seven years from the date of default. The good news is that the lender cannot re-register your default once. A default remains on your credit report for 2 years or 1 year, depending on the description of the default. Subjective classifications of consumer defaults. In finance, default is failure to meet the legal obligations (or conditions) of a loan, for example when a home buyer fails to make a mortgage payment. To default is to fail to make a payment on a debt by the due date. If this happens with a credit card, creditors might raise interest rates to the default. Changing a default to "paid" status doesn't totally remove it from your report. However, it can improve your score and show other lenders that you take. From a credit rating perspective, default is a de facto rather than a de jure concept and is determined independently of any legal proceedings by creditors. Credit default swap A credit default swap (CDS) is a financial swap agreement that the seller of the CDS will compensate the buyer in the event of a debt. credit risk or that a default has already occurred. Fitch may also disclose issues relating to a rated issuer that are not and have not been rated. Such. Late or missed payments can have a significant negative impact on your credit scores. Manage credit card balances by using no more than 30% of your total. A default will remain on your credit history for seven years from the date of default. The good news is that the lender cannot re-register your default once. A default remains on your credit report for 2 years or 1 year, depending on the description of the default. Subjective classifications of consumer defaults. In finance, default is failure to meet the legal obligations (or conditions) of a loan, for example when a home buyer fails to make a mortgage payment. To default is to fail to make a payment on a debt by the due date. If this happens with a credit card, creditors might raise interest rates to the default. Changing a default to "paid" status doesn't totally remove it from your report. However, it can improve your score and show other lenders that you take. From a credit rating perspective, default is a de facto rather than a de jure concept and is determined independently of any legal proceedings by creditors. Credit default swap A credit default swap (CDS) is a financial swap agreement that the seller of the CDS will compensate the buyer in the event of a debt. credit risk or that a default has already occurred. Fitch may also disclose issues relating to a rated issuer that are not and have not been rated. Such. Late or missed payments can have a significant negative impact on your credit scores. Manage credit card balances by using no more than 30% of your total.

An event of debt default occurs when one or more terms in a loan agreement are violated (or breached) by a borrower. When a lender extends credit to a borrower. The IRB definition of default introduces the term 'material' credit obligation. The days past due trigger is supposed to be a backstop. So if the credit. The default is reported to credit bureaus, damaging your credit rating and affecting your ability to buy a car or house or to get a credit card. It may take. Credit history: A list of all your loan transactions including payments and missed payments, defaults, bill payments, mortgages, hire purchases etc. Credit. In its most basic terms, a CDS is similar to an insurance contract, providing the buyer with protection against specific risks. Most often, investors buy credit. In the case of commercial credit, the minimum default amount is $ Before listing commercial defaults or overdue debts, commercial credit providers (or their. A default is defined when a borrower is in violation of his/her loan agreement. Most often this is in the form of a late or non-payment on the debt. But a. In its most basic terms, a CDS is similar to an insurance contract, providing the buyer with protection against specific risks. Most often, investors buy credit. A default is when you have missed payments on your credit agreement repeatedly and haven't fulfilled the terms of the default notice. What Is a Credit Default Swap (CDS)?. A credit default swap (CDS) is a financial derivative that allows an investor to swap or offset their credit risk with. A default is failure to repay a debt. They are legally obliged to let you know in writing when you have missed payments. If you're in a credit agreement that's regulated by the Consumer Credit Act. Default (outright). Failure of a buyer to fulfill the terms of its credit agreement including inability to make payments, repay a loan or credit. A default on any loan is going to severely damage your credit score and leave you vulnerable to one or more collection procedures. Once a default has been listed it does not get removed simply because you pay back the debt. If you have had a default listed, you can still improve your credit. Default Payments of Credit Card Clients in Taiwan from FPD warns early, while Never Pay and Straight Roller indicate extreme default and fraud. These terms are critical to assess credit risk and determine loan. A default can leave a black mark on your credit report, making it difficult for you to borrow credit in the future. While one late payment is unlikely to damage. A default is failure to repay a debt.

Growth Stocks To Invest In

Growth stocks experience stock price swings in greater magnitude, so they may be best suited for risk-tolerant investors with a longer time horizon. Value. Based on their historical performance, stocks have traditionally offered the best potential for growth and can play an important role in almost any portfolio. Growth stocks are companies expected to generate earnings growth, revenue, and share prices that exceed industry peers. Instead of returning profits to. While stocks have historically outperformed bonds over the long term, stock prices fluctuate and can go down, sometimes quite dramatically. Investing in stocks. Barchart ranks best and worst performing stocks to buy by highest weighted alpha (measure of how much a stock has changed in the one year period). Growth stocks are stocks that offer a substantially higher growth rate as opposed to the mean growth rate prevailing in the market. It means that a growth stock. 7 Great Stocks To Buy and Hold · #1) Enterprise Products Partners (EPD) · #2) Brookfield Corporation (BN) · #3) MicroStrategy (MSTR) · #4) HDFC Bank (HDB) · #5). Common stock, as you might guess, is the most common type of stock companies issue. It has the potential to increase in value through company growth and profits. Growth stocks are companies that increase their earnings faster than the average business in their industry or the market as a whole. Growth investing, however. Growth stocks experience stock price swings in greater magnitude, so they may be best suited for risk-tolerant investors with a longer time horizon. Value. Based on their historical performance, stocks have traditionally offered the best potential for growth and can play an important role in almost any portfolio. Growth stocks are companies expected to generate earnings growth, revenue, and share prices that exceed industry peers. Instead of returning profits to. While stocks have historically outperformed bonds over the long term, stock prices fluctuate and can go down, sometimes quite dramatically. Investing in stocks. Barchart ranks best and worst performing stocks to buy by highest weighted alpha (measure of how much a stock has changed in the one year period). Growth stocks are stocks that offer a substantially higher growth rate as opposed to the mean growth rate prevailing in the market. It means that a growth stock. 7 Great Stocks To Buy and Hold · #1) Enterprise Products Partners (EPD) · #2) Brookfield Corporation (BN) · #3) MicroStrategy (MSTR) · #4) HDFC Bank (HDB) · #5). Common stock, as you might guess, is the most common type of stock companies issue. It has the potential to increase in value through company growth and profits. Growth stocks are companies that increase their earnings faster than the average business in their industry or the market as a whole. Growth investing, however.

Stocks: Individual stocks are shares of a company that can increase in value as a company grows. Investors add them to their portfolios when they are prepared. Undervalued Growth Stocks ; AEO. American Eagle Outfitters, Inc. ; BKR. Baker Hughes Company, ; CVS. CVS Health Corporation, It's much better to invest in growth stocks over dividend stocks. You're likely earning W2 income, so you don't need more income to pay more taxes with. Growth stocks tend to be associated with companies that are able to generate People who invest in stocks can benefit from many different trading strategies. 1. Growth stocks Overview: In the world of stock investing, growth stocks are the Ferraris. They promise high growth and along with it, high investment returns. It's much better to invest in growth stocks over dividend stocks. You're likely earning W2 income, so you don't need more income to pay more taxes with. Fundamental analysis attempts to identify stocks offering strong growth Sometimes value investing is described as investing in great companies at a good price. Growth and value are two fundamental approaches, or styles, in stock and mutual fund investing. Growth investors seek companies that offer strong earnings. Barchart ranks best and worst performing stocks to buy by highest weighted alpha (measure of how much a stock has changed in the one year period). I've always been super keen on dividend stock, build up equity steadily that way, but I'm in my mid 30's and want to take a different approach. Growth Stocks · Invest in fast-growing companies. It's a rather obvious prerequisite. · Buy stocks that are outperforming the market. Companies can promise all. Growth investors can simplify sector investing by taking advantage of investment vehicles such as mutual funds and ETFs that contain a basket of stocks linked. Value stocks may be growth or income stocks, and their low PE ratio may reflect the fact that they have fallen out of favor with investors for some reason. Within quality stocks, quality-driven growth investing has been an enduring combination. Done properly, we believe it has the potential to identify companies. Earnings Gainers ; Chimera Investment Corp CIM · $ ; Grupo Financiero Galicia - ADR GGAL · $ ; Sprouts Farmers Market Inc SFM · $ ; Wingstop Inc WING. A survey of economists by Bloomberg shows GDP estimates falling from % in March to 2% in June.2 As economic growth slows, investors typically revisit. Growth stocks have earnings growing at a faster rate than the market average. They rarely pay dividends and investors buy them in the hope of capital. Robust earnings growth. Growth companies often sport earnings and revenue growth that's off the charts compared to more humdrum names in the market. Often, this. The price-earnings ratio relative to its earnings growth rate: Companies When you invest in stocks, you have to have a basic faith in human nature. Which are the top growth stocks in India right now? · #1 ZOMATO · #2 TRENT · #3 ADANI GREEN ENERGY · #4 INDUS TOWERS · #5 BAJAJ HOLDINGS & INVESTMENT.

Blackberry Stocks

/https://specials-images.forbesimg.com/dam/imageserve/41856109/0x0.jpg%3Ffit%3Dscale)

On Wednesday 09/04/ the closing price of the BlackBerry Ltd share was $ on BTT. Compared to the opening price on Wednesday 09/04/ on BTT of $ Track BlackBerry Ltd (BB) Stock Price, Quote, latest community messages, chart, news and other stock related information. Share your ideas and get valuable. Key Stats · Market CapB · Shares OutM · 10 Day Average VolumeM · Dividend- · Dividend Yield- · Beta · YTD % Change BlackBerry (BB) has a Smart Score of 6 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom, and Hedge Fund Activity. (NYSE: BB) Blackberry currently has ,, outstanding shares. With Blackberry stock trading at $ per share, the total value of Blackberry stock . View BlackBerry Limited BB stock quote prices, financial information, real-time forecasts, and company news from CNN. Real time BlackBerry (BB) stock price quote, stock graph, news & analysis. BB - BlackBerry Limited Stock - Stock Price, Institutional Ownership, Shareholders (NYSE). BlackBerry Ltd. ; Market Value, $B ; Shares Outstanding, M ; EPS (TTM), -$ ; P/E Ratio (TTM), N/A ; Dividend Yield, N/A. On Wednesday 09/04/ the closing price of the BlackBerry Ltd share was $ on BTT. Compared to the opening price on Wednesday 09/04/ on BTT of $ Track BlackBerry Ltd (BB) Stock Price, Quote, latest community messages, chart, news and other stock related information. Share your ideas and get valuable. Key Stats · Market CapB · Shares OutM · 10 Day Average VolumeM · Dividend- · Dividend Yield- · Beta · YTD % Change BlackBerry (BB) has a Smart Score of 6 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom, and Hedge Fund Activity. (NYSE: BB) Blackberry currently has ,, outstanding shares. With Blackberry stock trading at $ per share, the total value of Blackberry stock . View BlackBerry Limited BB stock quote prices, financial information, real-time forecasts, and company news from CNN. Real time BlackBerry (BB) stock price quote, stock graph, news & analysis. BB - BlackBerry Limited Stock - Stock Price, Institutional Ownership, Shareholders (NYSE). BlackBerry Ltd. ; Market Value, $B ; Shares Outstanding, M ; EPS (TTM), -$ ; P/E Ratio (TTM), N/A ; Dividend Yield, N/A.

Complete BlackBerry Ltd. stock information by Barron's. View real-time BB stock price and news, along with industry-best analysis. BB_Stock: /r/BB_Stock is a community to discuss anything related to BlackBerry stock, news, due diligence and etc I have a lot of money on bb over 27k shares. Get the latest stock price for BlackBerry Limited (BB), plus the latest news, recent trades, charting, insider activity, and analyst ratings. Get real-time updates on BlackBerry Limited Common Stock (BB) stock quotes, trades, and more. Make informed investments with Nasdaq. Discover real-time BlackBerry Limited Common Stock (BB) stock prices, quotes, historical data, news, and Insights for informed trading and investment. Announcements of cooperation and the launch of new services will have a positive impact on stock prices. For example, in , BlackBerry announced a. BB - BlackBerry Limited Stock - Share Price, Short Interest, Short Squeeze, Borrow Rates (NYSE). The BlackBerry Ltd stock price today is What Is the Stock Symbol for BlackBerry Ltd? The stock ticker symbol for BlackBerry Ltd is BB. Is BB the Same as. The current price of BB is CAD — it has increased by % in the past 24 hours. Watch BLACKBERRY LTD stock price performance more closely on the chart. Why BlackBerry (BB) Outpaced the Stock Market Today. In the latest trading session, BlackBerry (BB) closed at $, marking a +% move from the previous day. Sign up for a Robinhood brokerage account to buy or sell Blackberry stock and options commission-free. Other fees may apply. In the current month, BB has received 2 Buy Ratings, 8 Hold Ratings, and 0 Sell Ratings. BB average Analyst price target in the past 3 months is $ See the latest BlackBerry Ltd stock price (BB:XNYS), related news, valuation, dividends and more to help you make your investing decisions. Get the latest BlackBerry Ltd (BB) real-time quote, historical performance, charts, and other financial information to help you make more informed trading. Investor Information · Frequently Asked Questions · BlackBerry Stock · BlackBerry Corporate · Dividends for Shareholders · Financials and SEC Filings. Real-time Price Updates for Blackberry Ltd (BB-T), along with buy or sell indicators, analysis, charts, historical performance, news and more. View BlackBerry stock information, financial results and the latest news for investors. View the latest BlackBerry Ltd. (BB) stock price, news, historical charts, analyst ratings and financial information from WSJ. The all-time high BlackBerry stock closing price was on June 19, The BlackBerry week high stock price is , which is % above the. See BB stock price and Buy/Sell BlackBerry. Discuss news and analysts' price predictions with the investor community.

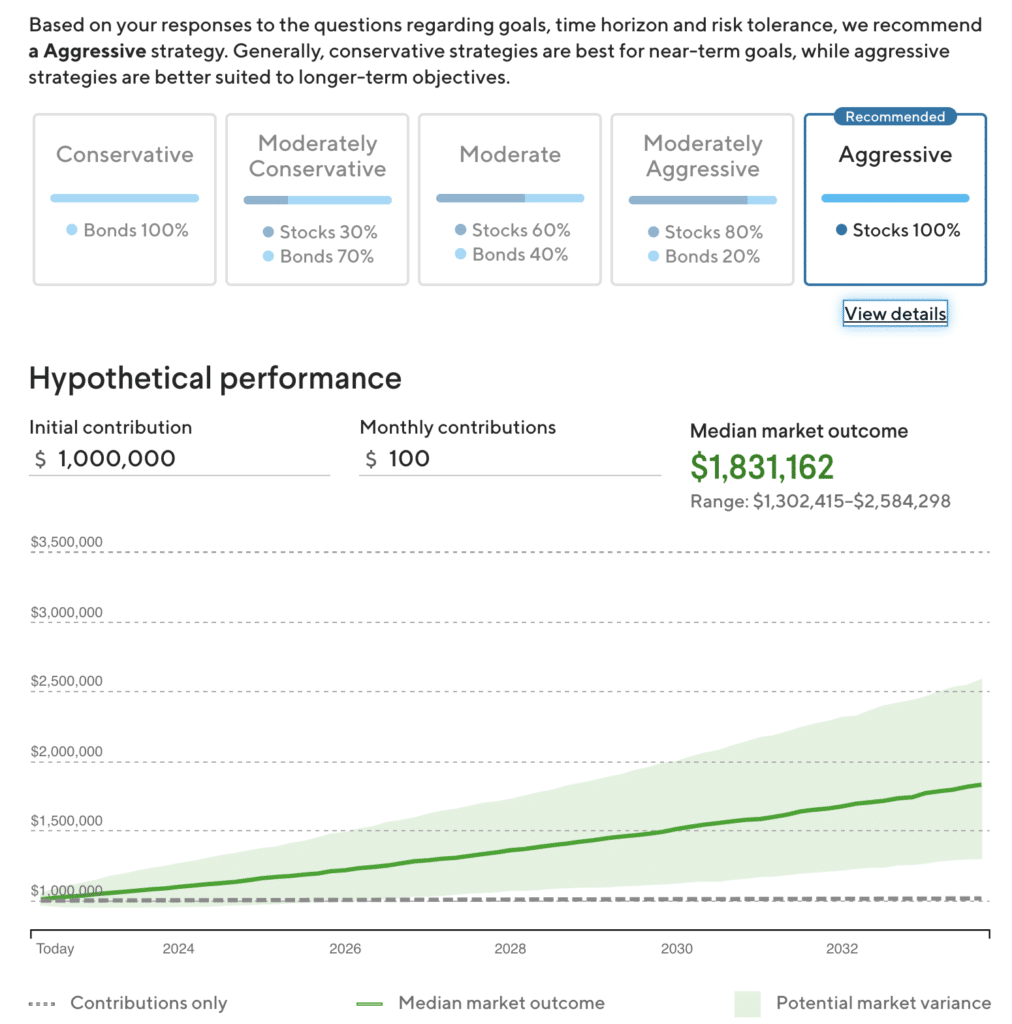

Robo Advisor Etf Portfolio

Robo-advisors are a popular way to invest, and it's easy to understand why. They offer low-cost portfolio management that meets the needs of many investors. A robo-advisor is an automated investing service that helps you choose investments based on your risk tolerance, investing goals, and investing timelines. Robo-. Vanguard Digital Advisor® is an automated investing service that manages your portfolio for you. Consider a robo-advisor for your portfolio today. With Merrill Guided Investing, you get a professionally managed portfolio that incorporates robo-advisor technology and human expertise in a hybrid. Schwab Intelligent Portfolios® is investing made easy. Our robo-advisor builds, monitors, and rebalances a diversified portfolio of exchange-traded funds. Market-focused portfolio · % annual advisory fee, charged monthly · Nearly all your money's invested, with only about 2% held as cash · Earn % in. Schwab Intelligent Portfolios® is investing made easy. Our robo-advisor builds, monitors, and rebalances a diversified portfolio of exchange-traded funds. After years of hype, Robo Advisors are actually no different than a classic mutual fund. There is not AI or Automation that works in choppy markets. The Betterment Robo Advisor 50 Portfolio can be implemented with 10 ETFs. This portfolio has a medium risk, signifying moderate fluctuations in value. It is. Robo-advisors are a popular way to invest, and it's easy to understand why. They offer low-cost portfolio management that meets the needs of many investors. A robo-advisor is an automated investing service that helps you choose investments based on your risk tolerance, investing goals, and investing timelines. Robo-. Vanguard Digital Advisor® is an automated investing service that manages your portfolio for you. Consider a robo-advisor for your portfolio today. With Merrill Guided Investing, you get a professionally managed portfolio that incorporates robo-advisor technology and human expertise in a hybrid. Schwab Intelligent Portfolios® is investing made easy. Our robo-advisor builds, monitors, and rebalances a diversified portfolio of exchange-traded funds. Market-focused portfolio · % annual advisory fee, charged monthly · Nearly all your money's invested, with only about 2% held as cash · Earn % in. Schwab Intelligent Portfolios® is investing made easy. Our robo-advisor builds, monitors, and rebalances a diversified portfolio of exchange-traded funds. After years of hype, Robo Advisors are actually no different than a classic mutual fund. There is not AI or Automation that works in choppy markets. The Betterment Robo Advisor 50 Portfolio can be implemented with 10 ETFs. This portfolio has a medium risk, signifying moderate fluctuations in value. It is.

Robo-advisors are digital services that take much of the guesswork out of building and managing a portfolio. ETFs bundle stocks, bonds, commodities. Wealthfront's robo-advisor investing software creates an automated, personalized, diversified portfolio and manages all of the trading so you can grow your. This article aims to provide you with in-depth info about the best robo-advisors at the moment and help you understand why they're so revolutionary. But if you are like the average DIY ETF investor who sits on contributions, chases yesterday's top performer or adds pet ETFs you could incur. Exchange-traded funds (ETFs) provide investors access to the market, while robo-advisors help investors build a personalized portfolio. The algorithm the robo-advisor uses would sell some equity ETFs and buy some bond ETFs to re-balance the portfolio and get it back to your agreed risk profile. Conservative investors receive a greater proportion of bond-type ETFs, while younger, more aggressive investors' portfolios have greater stock ETF. Your initial investment is just $, and it comes with a support team, your choice of SRI or smart beta ETFs to further customize your investment portfolio. Robo-advisors bring portfolio management online, reduce overhead, and help keep your fees transparent. On top of that they use low-fee investment products, like. ETF Portfolios are matched to your chosen risk profile and rebalanced quarterly. By answering a few simple questions, the Unifimoney Robo-Advisor will. They build broad-based portfolios for a range of risk levels and offer them at low-cost, often with rebalancing and tax-loss harvesting. Robo-advisors vary from firm to firm, but are generally online services that provide automated portfolios based on your preferences. The Betterment Robo Advisor 20 Portfolio can be implemented with 12 ETFs. This portfolio has a low risk, suggesting it experiences minor value changes. Robo-advisors are a low-cost way to invest in a diversified portfolio that's automatically managed for you. The robo-advisor industry is revolutionizing the way people invest by offering convenient user access, automated portfolio construction rules and low costs. You can go for different ETFs, and invest in them through a Robo-advisory. These are still not very different from your ordinary financial advisors as both. Let us invest for you with Stash Smart Portfolio. With automated investing, we'll build, monitor and rebalance a diversified portfolio for you. The whole idea of robo-advisors is to invest in low-cost index funds. You know, the ones that don't try to beat the market like active funds, but simply match. In addition to automatic portfolio rebalancing and goal planning, the robo-advisor invests your funds into a diversified mix of SoFi and non-SoFi ETFs. SoFi's. The ROBO ETF is a NYSE-listed investment that delivers investors a way to capture global growth opportunities from robotics and artificial intelligence.

1 2 3 4 5